21 minutes agoAuthor: Shashank Shukla

- Copy link

In us Many people find it difficult to understand things like investment and insurance. We want that it is better if both work is done with any one scheme. Actually, both investment and insurance can be made simultaneously through the ULIP plan.

Who likes the hassle of investing money in different policy and schemes? In such a situation, people seek an option in which there is also savings, risk cover should also be found and returns are also good.

ULIP i.e. Unit Linked Insurance Plan is a policy in which you get a chance to invest in life insurance as well as stock market or date funds. But as with every investment, it also has benefits and some precautions are also necessary.

In such a situation, today we Your money In this column of we will talk that-

- What is Ulip and how does it work?

- What are its advantages and risks?

- How is this compared to options like traditional insurance and SIP?

Question- What is Ulip Plan?

answer- Ulip means unit linked insurance plan. It is a life insurance policy that gives you both insurance and investment advantage together.

It regulates IRDAI (Indian Insurance Regulatory and Development Authority). In this, some part of the premium you fill is used for your life insurance cover.

It gives financial security to your family. The rest of the money is invested in different funds like equity, date or money market funds.

For example, suppose you are 35 years old and you buy an Ulip for 20 years, in which you pay a premium of Rs 50,000 every year.

Out of this 50,000 rupees, about Rs 5,000 can be deducted for insurance cover and remaining expenses, and the remaining Rs 45,000 will be invested in your chosen funds.

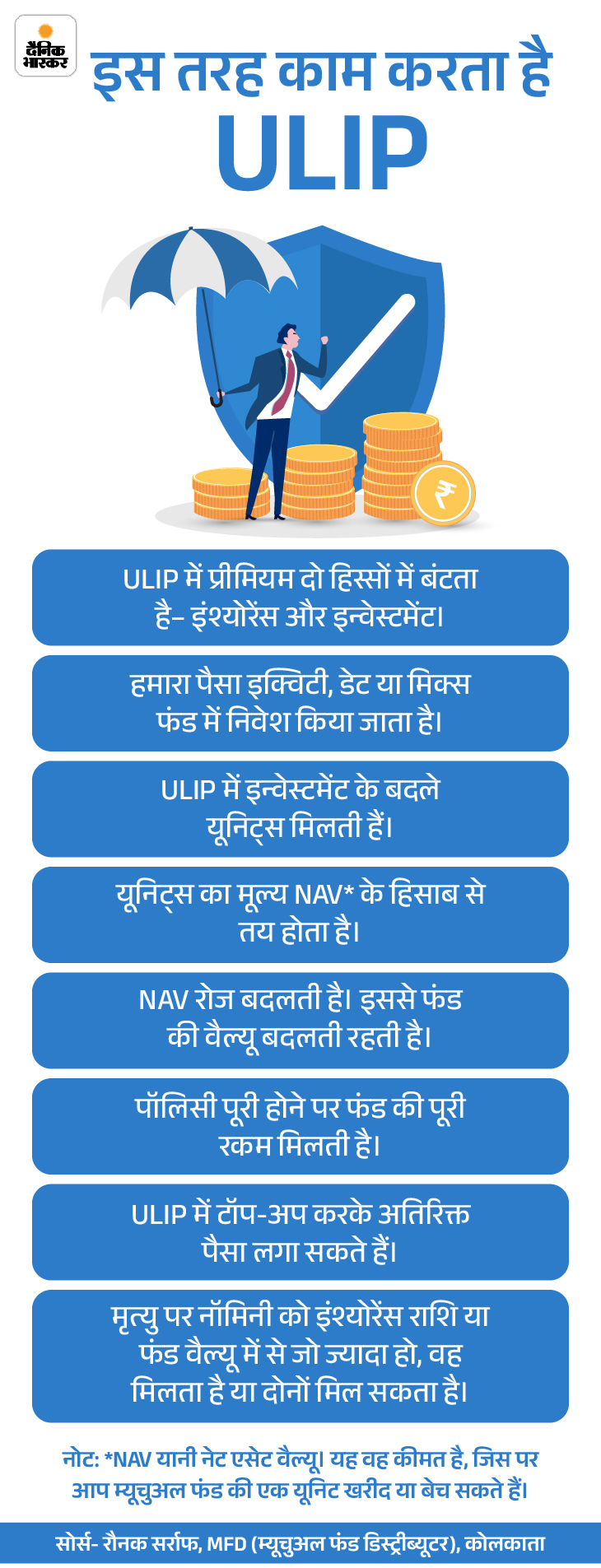

Question- How does Ulip work?

answer- How Ulip works, let’s consider it to be step by step with the help of graphic.

Let’s understand graphics in detail

Premium sharing When you fill the premium, a part of it goes to life insurance cover and the remaining part is invested in your chosen fund. You can choose equity, date or mix funds according to your choice.

Units Investments are converted into units. The value of each unit is decided on the basis of its NAV. For example, if the Nav is 100 rupees and you invest 40,000 rupees, then you will get 400 units.

NAV and Fund Price NAV varies according to market performance. The total value of your fund is extracted by multiplying the number of your units by NAV. If the NAV increases to Rs 1000, then the price of your 400 units will be Rs 4,00,000.

In the event of death If the policyholder dies, the nominee gets death benefits. It can be found either the sum assured (insurance amount) or the fund value, or in some schemes, both can also be found.

For example, if the insurance amount is Rs 5,00,000 and the fund price is Rs 6,00,000, then the beneficiary can get Rs 6,00,000 (which is higher) or Rs 11,00,000 (both of the sum, type of policy).

Benefits of maturity On completion of the policy period, you get the full value of the fund. For example, if the NAV on maturity is 700 rupees and you have 1800 units, then you will get 12,60,000 rupees.

Additional Facilities of ULIP You can also fill the top-up premium in the Ulip, so that you can invest more money. You can also switch between funds (change your investment from one fund to another) and also partial withdrawal (withdrawing money) after a lock-in period.

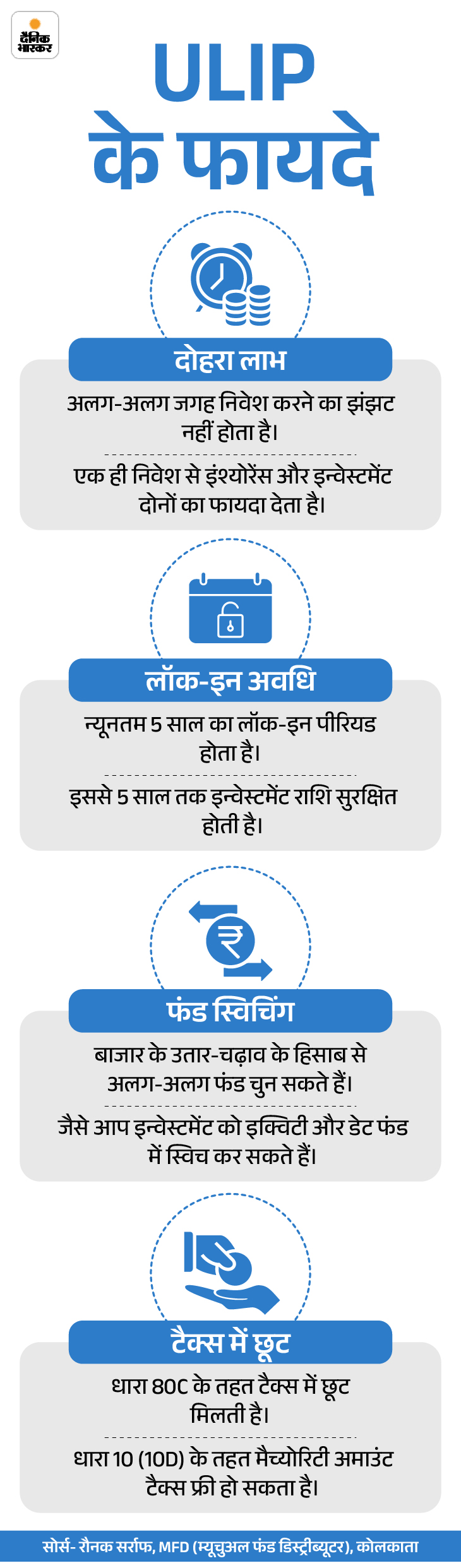

Question- What are the benefits of Ulip?

answer- Ulip has many advantages that make it a good investment option. Let us understand it through graphic.

Let us understand graphics in detail.

Investment and insurance mail ULIP gives the benefit of both life insurance and investment in the same policy. This does not require you to buy different products.

Return related to market Your money is spent in the market, especially in equity funds, there is a possibility of getting good returns in long periods, which can also beat inflation.

Is flexibility You can choose funds according to the ability to take your risk and also switch between funds from time to time. Typically, there is no capital gains tax on such switch.

Partial withdrawal can After the completion of a 5-year lock-in period, you can withdraw some money from your funds for emergency needs. However, this may affect your insurance cover.

Get tax benefit Under Section 80C of the Income Tax Act, you get tax exemption at a premium of up to ₹ 1.5 lakh, provided the premium sum assords do not exceed 10% of the assord. The amount received on maturity under Section 10 (10D) can also be tax-free.

There is transparency You get information about investment and fund performance in ULIP regularly, so that you can keep an eye on your investment.

Option to add extra cover You can add extra cover to the ULIP plan, such as an accident or serious illness. There is also an option to fill the premium annual, half, quarterly or monthly.

Question- What are the disadvantages of Ulip?

answer- There are also some disadvantages of ULIP that need to be known before investing.

Gets more charged ULIP has many types of charges (eg premium allotment, fund management etc.). These charge returns can be reduced in the initial years.

There is a risk of market ULIP money is spent in share or date market. In such a situation, there is a risk of fluctuations in the stock market. There may be damage if the market declines during drainage in a short time.

Lock-in period is You cannot withdraw money for 5 years. Penalty may have to be given on premature policy.

Everyone is difficult to understand Many people do not understand the structure of ULIP and the charge in it. This requires information related to changing funds i.e. switching.

Insurance cover is low ULIP has low insurance cover. If you want more cover, it is better to take a separate term plan.

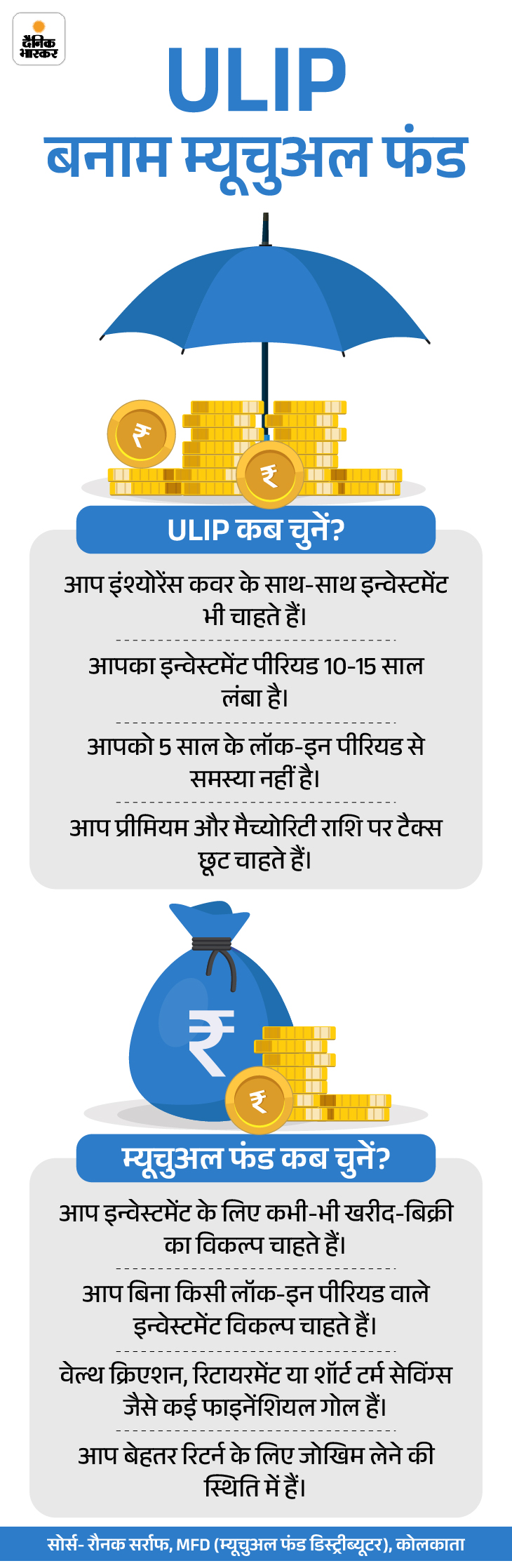

Question- What is the difference between mutual funds and ULIP? Is it better to choose?

answer- Both mutual funds and ULIP investment are correct. In this you have to see what is right for you? Let us understand it through graphic.

Question- What precautions should be taken while investing in ULIP?

answer- These things should be kept in mind before investing in ULIP.

Understand the charge levied: ULIP has many types of charges, such as fund management and allotment charge. Initially they affect charge returns.

Choose funds according to risk: If you are in a position to take a risk, then choose the equity fund. If you do not want to take risk, then choose a date fund.

For long period: If you want better returns, then hold the ulip for at least 5 to 10 years.

Check insurance cover: Before taking Ulip, check whether the insurance is being received is according to your need or not.

See the performance of the fund: Before taking the policy, compare the funds of different companies, see which fund is performing better on platforms like Policy Bazaar.

Read terms and conditions: Before taking the ulip plan, take the plan only after understanding the rules of withdrawal and surrender of funds.

Match the target: Take the ulip plan only keeping in mind the purpose of the future. For example, your plan can meet your children’s education, your own retirement and whether it can.

Do regular check: Look at how the fund is going, from time to time and switch to different funds if needed.

Choose a good company: While choosing the Ulip Plan, make a company whose claim settlement is good.

,

Also read this news related to personal finance

Your money- Your money- Never sell mutual funds in emergency: Funds of funds of funds, know the rules and benefits of taking loans

According to a report by Motilal Oswal, a financial service company, about four crore people in India invest in mutual funds, that is, about 3% percent of the country’s population. People do this to make their future safe. Read full news