2 minutes agoAuthor: Shashank Shukla

- Copy link

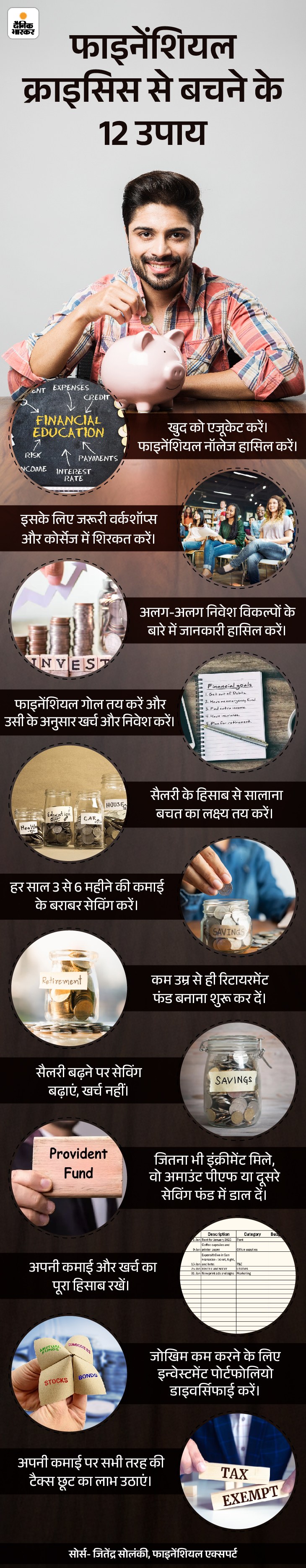

S & p global According to a survey by Finalit, only 24% of people in India are financially agreed. That is, people who have a basic understanding of money. Financial literacy means to know how to make a budget, how to save, where and how to invest your earnings. Also how to handle the debt.

However, most people ignore these things and take some wrong economic decisions, which have to bear the brunt for a long time. Such people do not have any emergency funds and also spend more than necessary.

Usually take loans without thinking, due to which gradually get caught in the debt trap, which becomes a major reason for stress.

Such people think that saving will be easier to increase earnings or increase salary, but in reality it does not happen. As soon as the salary of every month comes, it ends in a few days and then how to spend the same worry, and how to save?

In such a situation, today we Your money Will know in the column that-

- Why is it not able to save even after the salary increases?

- How can you control expenses?

- How can a part of earnings be spent in saving and investment?

Question- Why does it not be saved even after the salary increases?

answer- Actually, when our salary increases, our expenses also increase in the same proportion. Even though the old budget has been sufficient for our expenses, despite this we give the name of need to new expenses. Whereas as the salary increases, our needs do not change, but habits and desires change.

We start spending more than necessary, without thinking how important the savings are for the future. If we do not bring changes in our way of spending, then we will remain upset.

Question- Why does our expenses increase after salary increased?

answer- If you are not alert, it is natural to increase the expenditure after increasing salary. This is called ‘lifestyle inflation’. When people’s earnings increase, they think that now they can buy better things than before. Such as expensive phones, food outside, luxury clothes.

Over time, these habits seem to be needed and expenses automatically increase. But if saving habit is not added to the salary, then the same remains the same.

Question- What to do to control expenses?

answer- To control the expenses, first of all it is important to make a budget of every month i.e. how much income and where it is being spent.

After this, mark the things of wasteful and remove them slowly. Such as frequent food, unnecessary subscription or shopping. Mobile apps or diaries can also be used to track expenses.

Question- Is there any formula that maintains saving and expenses?

answer- 50:30:20 Formula is an easy way to spend money wisely. In this, you divide your every month’s earnings into three parts. First keep 50% share for your important expenses, such as fare, buying ration, children’s fees, electricity-water bill etc.

After this, keep 30% share for your desires. Such as watching movies, eating out, shopping or walking. Apply the remaining 20% of the money in saving or investment, so that you do not have any problem of money.

With this formula, you can balance both your needs and hobbies without spending unnecessarily, as well as saving for the future.

Question- How to start saving?

answer- Saving can also be started with small amounts. The best way is to take the savings first as soon as the salary arrives, not in the end, add the remaining money into saving. You can start SIP from 1000–2000 rupees or also choose a safe option like PPF and FD.

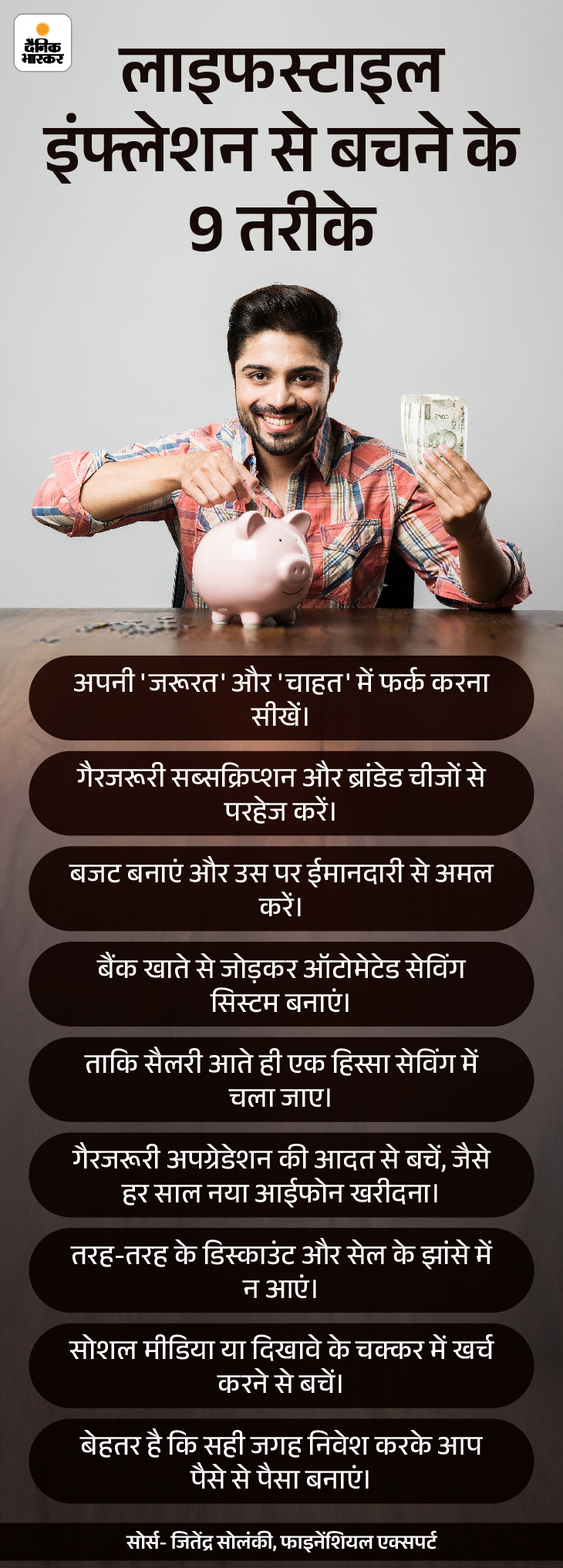

Question- How can lifestyle inflation be avoided?

answer- Lifestyle inflation means that as the income increases, the expenditure is also increased in the same proportion. This does not make saving. Some easy measures can be adopted to avoid this. Let us understand it through graphic.

Question- How to make a savings plan for married people?

answer- After marriage, both partners are responsible for saving and for this mutual understanding is most important. First of all, keep transparency about the income and expenses of both. Sit together every month and make a budget and give priority to the important things.

Together, decide a fixed saving target. For example, the target of saving Rs 10,000 every month. Prepare separate savings plans for big financial goals like children’s education, emergency funds and retirement. Also distribute expenses among themselves.

If both of you are employed or are earning, then distribute expenses separately. For example, one partner is filling EMI, the other should manage the grocery or other needs.

Start long -term investment like SIP, PPF or FD together. With transparency and cooperation, husband and wife can not only take responsibility for expenses, but can also create a strong financial foundation.

,

Also read this news related to personal finance, make your money by the age of 40, make one crore funds: age 22 years, salary 20 thousand, know where, how much and how to do investments

Whenever we have our first job, we do not have any expenses nor responsibilities. During this time, we spend our earnings in walking, watching movies, fulfilling hobbies. Read full news