40 minutes ago

- Copy link

Social A shocking video on the media is becoming increasingly viral, in which the new credit card scam at the petrol pump has been revealed. In this video, a person cautioned people that please do not use the credit card at the petrol pump, otherwise your bank account may be empty.

This video has been shared by a user named Sarthak Ahuja and so far it has been viewed more than 7 million times. The video states that a man swipe the card while filling the petrol and a few days later more than one lakh rupees were stolen from his account.

So let’s Cyber literacy In the column, you will know what is a credit card fraud? Will also know that-

- What is important to take care of to avoid this?

Expert- Rahul Mishra, Cyber Security Advisor, Uttar Pradesh Police

Question- What is card skimming scam?

answer- Card skimming is a kind of fraud in which thugs steal your debit or credit card information. They hide a small device on the ATM machine, petrol pump or shop’s card swipe machine (POS machine), called a skimmer. This skimmer records your card information (such as card number and expiry date) when you enter or swipe your card in that machine. Many times a fake keypad or camera is also hidden above the keypad to steal the pin. Later, thugs make fake cards with this information and withdraw money or do shopping online.

Question- How to know that my card is a skim?

answer- If there is any money deducted from the account, which you have not spent then this can be the first sign of skimming. Often thugs first cut small amounts so that you or the bank do not suspect.

If recently the card has been used on a stranger or strange machine (ATM or shop card machine) and after that there is a disturbance in the account, then the same machine may be equipped with skimmer.

Question- Is there a higher risk of card skimming at petrol pump?

answer- Yes, there is a high risk of skimming at the petrol pump, as the card machines there are often in the open and they are less monitored. Scammers steal card data by planting skimming devices on these machines.

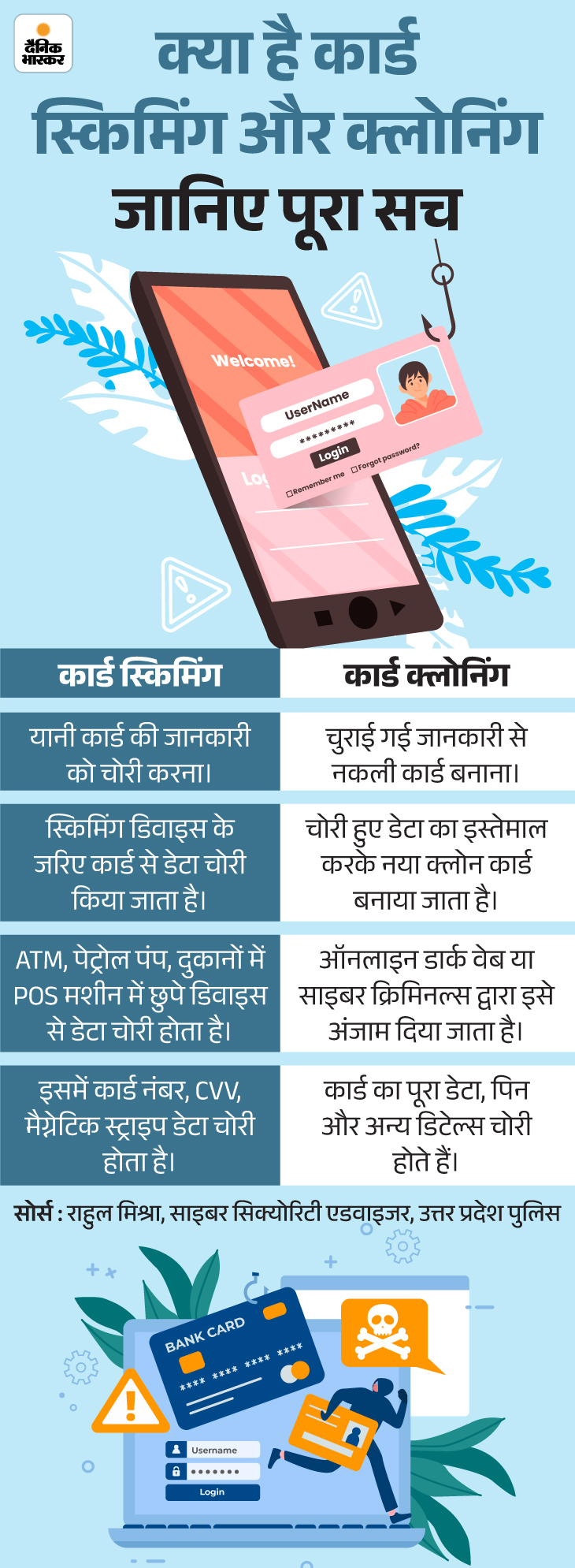

Question- What is the difference between card skimming and cloning?

answer- Cyber expert Rahul Mishra explains that skimming is the first stage in which thugs steal card number, PIN and second information. Cloning is the next stage, where the information is cheated by making duplicate cards. Understand it from the graphic below-

Question- Can online transactions also cause card skimming?

answer- Yes, online transactions can also cause card skimming. It is called e-scimming or fishing. In this, the thugs send you to the fake website or link, where you steal the card information, they steal it.

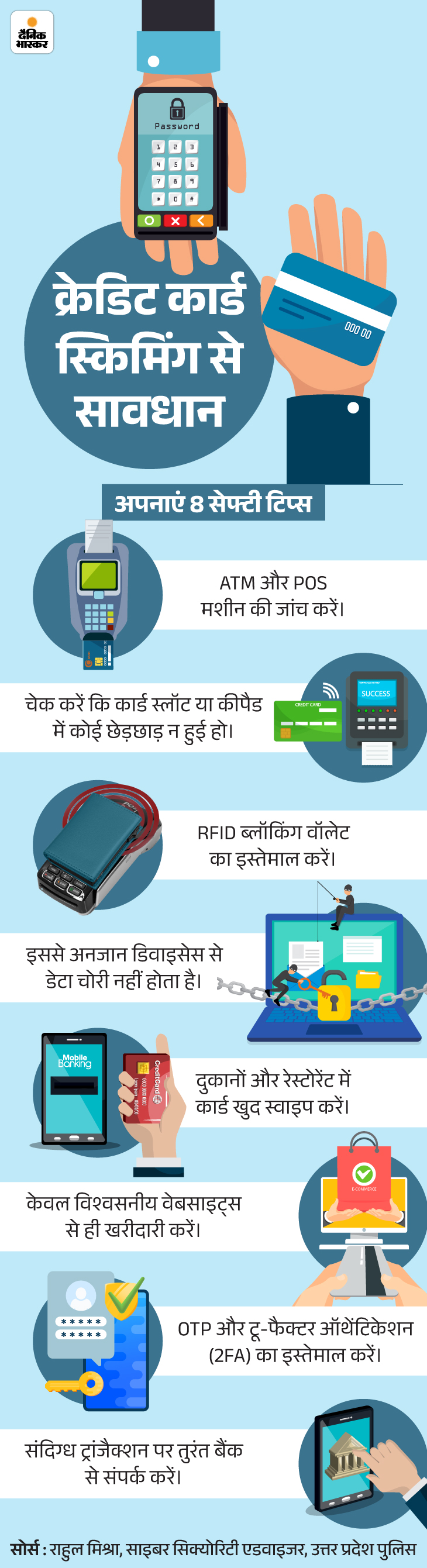

Question- What are the things to keep in mind to avoid credit card skimming scam?

answer- To avoid credit card skimming, it is very important to take care of some small but important things. Especially in places like petrol pump, where POS machines are in the open and it is difficult to monitor them.

Question- What is RFID blocking and how can it stop skimming?

answer- RFID blocking is a technology that protects your credit or debit card from scam. Nowadays there are many cards that have chip. This can also make payment without putting it in the machine. Scammer can steal your card information from a distance by misusing this technique. RFID blocking wallets, card covers or bags contain a particular type of layer (such as a metal thin sheet or special cloth). This layer does not allow the waves coming from the scammer scanner to reach the card. In this way your card is safe and its information is not stolen. These techniques are very useful in crowded places like metro, bus or market.

Question- If someone becomes a victim of skimming then what to do first?

answer- If someone has taken money out of your card by cheating, do not panic. You can reduce the loss by following the steps given below.

Call the bank immediately

First call your bank or block the card from the bank’s app. Tell them that you have been fraudulent. The sooner you do this, the less the loss will be.

Give complete information to the bank

Tell the bank that you have not done this transaction. Give information about the date, time and amount of transaction. Tell the bank to start the chargeback process, in which they try to bring back the money. For this, you may have to give complaint letters and transactions details.

Close international transactions

Scammers often use the card for online shopping abroad. If you suspect that this has happened, then stop the facility of international payment from the bank immediately.

Complain on cybercrime portal

It is not enough to tell only the bank. Go to www.cybercrime.gov.in by visiting the website and file a complaint online. If it is difficult to use the website, then go to the nearest police station or cybercrime cell and make a written complaint.

…………………… Read this news too…

New Zealand MP showed his deepfack nude in Parliament: Fake photos are being made from AI in 5 minutes, how to avoid, know 10 precautions

Today, deepfhek has become a dangerous weapon, not just a technology in social media and internet world. It can be used to spoil someone’s image, damage career or create an agenda. Especially youth, women and adolescent girls are at the most threat. Read full news …