3 minutes agoAuthor: Shashank Shukla

- Copy link

If If you have seen the option of ‘Bay Now Pay Letter’ or BNPL during online shopping, then you are not alone. Nowadays many people are using this facility.

In this, you can buy a product or service immediately and you can pay it later in easy installments. It seems very beneficial to hear, especially when the pocket is a little tight. But is BNPL really as beneficial as it looks?

Today we Your money In the column, we will understand about this and know that-

- What is BNPL?

- What is a better way to use it?

- What are its benefits? Does this improve credit score?

- How can its loss be avoided?

Question- What is Bay Now Pay Letter (BNPL)? answer- By Now, BNPL is a type of short -term loan, which allows buyers to repay the price of an object in installments instead of repaiding them simultaneously. It is usually used for shopping for smartphones, branded clothes or other expensive goods.

Compared to other loans, BNPL loans are usually interest-free and do not have additional fees or not. However, such a feature can often be trapped by people in a date trap.

Main things of by now pay letter

- By Now, BNPL is a short term loan service, which divides expensive shopping into small installments.

- This service is usually interest-free and is considered more economical than other finance options.

- The biggest benefit of BNPL is its convenience, so that customers can shop immediately.

- However, your credit score may deteriorate if not paid on time.

Question- How does ‘Bay Now Pay Letter’ work?

answer- ‘By Now Pay Letter’ (BNPL) acts like a loan, such as a personal loan, car loan or home loan. In this, when you buy something, the seller i.e. the seller already gets the entire payment from the company giving BNPL service.

Next, you gradually pay that amount to the BNPL company in installments. Often in this process, up to 25% down payment has to be made in the beginning.

For example, if you bought goods worth Rs 1,000, you will have to pay Rs 250 while shopping. You can pay the remaining 750 rupees in 5 installments of Rs 150 in the next few weeks or months.

In most cases, BNPL service company makes payment automatically with your bank account or credit card. Some companies also offer options for payment from check or bank transfer.

BNPL service companies usually do not charge interest, so they are cheaper than other loans. However, some companies may charge a minor service charge.

Question- What is the effect on the credit score of bye now, pay letter?

answer- By now, the loans of pay letters are not usually reported to the Credit Bureau. However, these Credit Bureau can be reported in case of default or non -payment of loan. Let us understand this through graphic what effect it has on credit score.

Question- What is a soft credit check?

answer- Many companies providing BNPL service do soft credit inquiry before applying loan or finance. This process is only for checking your profile. It has no negative effect on credit score. Its purpose is to see whether you are eligible to pay.

Question- What is a hard credit check?

answer- A few selected BNPL companies do hard credit checks before giving loans. This is exactly the same as the bank or credit card company does a loan or card before applying. The hard check may cause a slight decline in your credit score, especially if you have applied for credit several times recently.

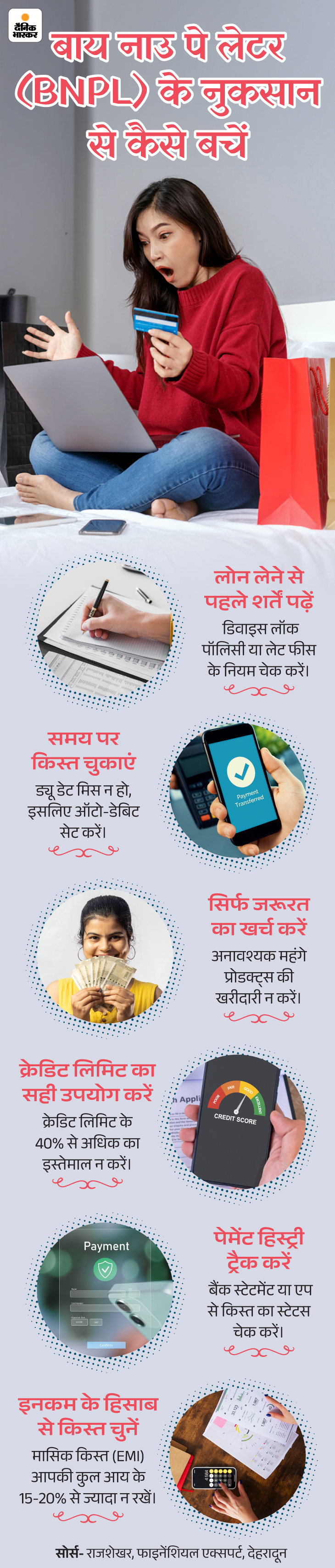

Question- How to use by now pay letter not to harm?

answer- We need to take some precautions while purchasing on BNPL or installment. By doing this we can avoid losses. Let us understand it through graphic.

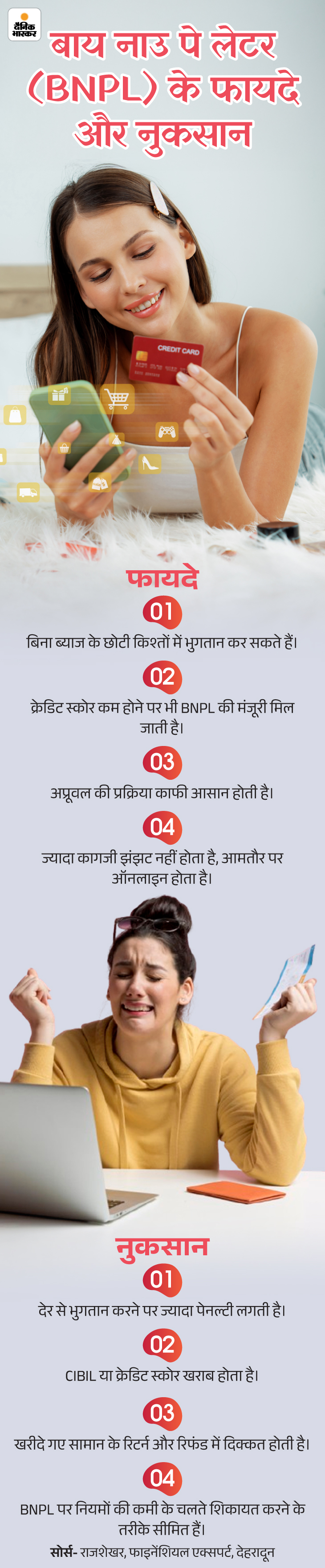

Question- What are the advantages and disadvantages of By now pay letters?

answer- ‘Bay Now, Pay Letter’ (BNPL) services provide a convenient way to buy expensive things in easy installments. Also, if there is no money, you can buy the necessary goods. It has these advantages, but the losses are not less. Let us understand it through graphic.

Let’s understand some points in detail.

Trouble in return and refund There is no strict rules and monitoring as banks on BNPL services due to new types of financial facilities. Payment in BNPL is made in installments over time, so if you want to return the goods, the process of stopping payment or getting refund is a bit complicated.

Lack of rules, reduced security BNPL services are less regulated than traditional credit cards or loans. This provides limited help or protection to consumers in a state of dispute.

Danger of spending more BNPL services provide the option of payment in small installments without interest, which also makes a cheaper purchases. With this, people can buy excess goods, due to which there is a risk of gradually increasing debt, not repaying installments and deteriorating credit score.

Scope of low regulation BNPL services are much less regulated than credit cards or other loans. This means that customers do not get the facility of so strong security and complaint solution.

Credit score and history risk of malfunction If not paid on time, the BNPL company can hand over your outstanding amount to the recovery or collection agency. Both credit score and credit history have a bad effect. Also, it can be difficult to take loans in future.

,

Also read this news related to personal finance

Your money- What is SIP ie Systematic Investment Plan: Investment can start from Rs 100, know the benefits of SIP, investment tips

In today’s time, we all want our future to be secured, so it has become very important to make savings and investment. There are many ways of savings and investment. Such as buying gold, investment in stock market, fixed deposit (FD), NPS and SIP, LIC etc. Read full news